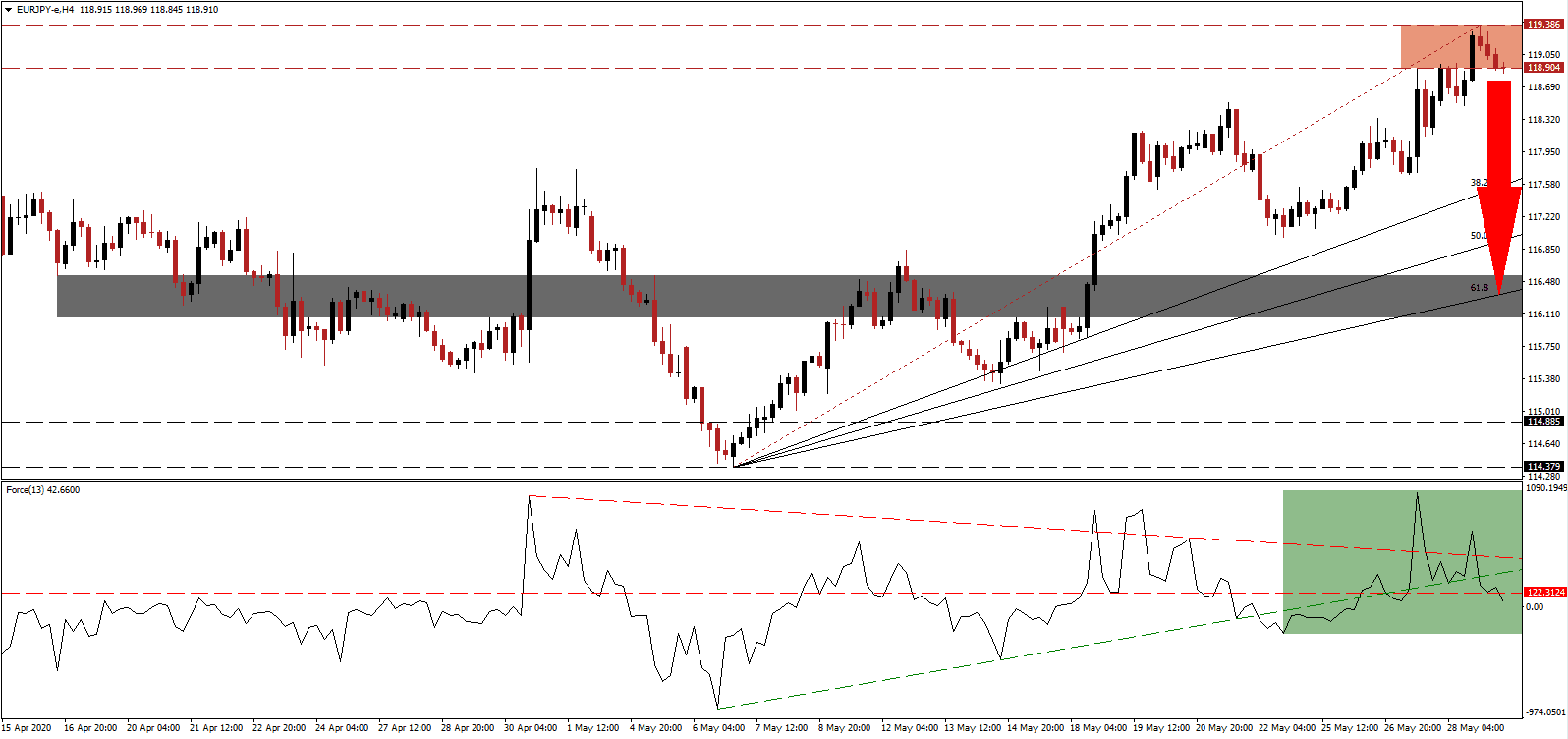

Eurozone economic data for May was significantly worse than anticipated, most notably in the services and industrial sentiment. The business climate deteriorated further, highlighting severe conditions across the currency bloc. Despite countries easing lockdowns in May, the worsening of points towards a weaker economy than economists and politicians hoped for, making any recovery longer and more painful than planned. The European Central Bank’s €750 billion stimuli and a Franco-German €500 billion EU-wide stimulus lifted the Euro, but it is now faced with economic reality. It led to a collapse in bullish momentum in the EUR/JPY, which is presently in the progress of breaking down below its resistance zone.

The Force Index, a next-generation technical indicator, initially spiked to a new multi-week high before reversing below its descending resistance level. A quick bounce was swiftly rejected, leading to a breakdown below its ascending support level, as marked by the green rectangle. A conversion of the horizontal support level into resistance followed, and this technical indicator is now poised to grant bears control of the EUR/JPY with a move into negative territory.

Japanese industrial production and retail sales data for April were dismal, but the Japanese Yen remains the primary safe-haven asset in the Forex market. US President Trump will host a news conference today in response to China’s passing of a new security law governing its semi-autonomous region Hong Kong. Markets anticipate a radical deterioration in the already complicated Sino-American relationship. It adds a bearish catalyst to the EUR/JPY, favored to enter a profit-taking sell-off after a breakdown below its resistance zone located between 118.904 and 119.386, as marked by the red rectangle.

A breakdown in this currency pair will close the gap to its ascending 38.2 Fibonacci Retracement Fan Support Level. Given the worse than forecast global economic condition, and new daily Covid-19 cases are surging to all-time highs, the risk-off sentiment is likely to return, and accelerate the pending correction in the EUR/JPY. Price action is positioned to challenge its short-term support zone located between 116.068 and 16.547, as identified by the grey rectangle. The 61.8 Fibonacci Retracement Fan Support Level is passing through this zone, but a probable breakdown extension will require a new catalyst.

EUR/JPY Technical Trading Set-Up - Profit-Taking Scenario

- Short Entry @ 118.900

- Take Profit @ 116.400

- Stop Loss @ 119.600

- Downside Potential: 250 pips

- Upside Risk: 70 pips

- Risk/Reward Ratio: 3.57

Should the Force Index accelerate above its descending resistance level, the EUR/JPY is likely to push higher temporarily. Forex traders are recommended to take advantage of any breakout attempt with new net short positions amid the worsening outlook for the Eurozone economy and an anticipated spike in demand for safe-haven assets. The next resistance zone awaits price action between 120.937 and 121.386.

EUR/JPY Technical Trading Set-Up - Limited Breakout Scenario

- Long Entry @ 120.150

- Take Profit @ 121.250

- Stop Loss @ 119.600

- Upside Potential: 110 pips

- Downside Risk: 55 pips

- Risk/Reward Ratio: 2.00